In the fast-paced world of cryptocurrency trading, crypto exchanges play a crucial role in facilitating the buying and selling of digital assets. From traditional centralized exchanges to the emerging decentralized exchanges (DEXs), the landscape of crypto trading is constantly evolving. In this article, we will delve into the rise of crypto exchanges, explore the world of decentralized exchanges, highlight the top DEXs to watch in the market, navigate the crypto swap landscape, discuss the importance of liquidity in crypto and DEX trading, compare Bitcoin, Ethereum, and Solana exchanges and swaps, and provide a beginner's guide on how to buy and sell cryptocurrency. Whether you're a seasoned trader or a newcomer to the world of crypto, understanding the ins and outs of these platforms is essential for successful trading. So, let's dive in and uncover the secrets of the crypto exchange universe.

1. The Rise of Crypto Exchanges: Understanding the Basics

The rise of crypto exchanges has been a fundamental aspect of the booming cryptocurrency industry. These platforms serve as marketplaces where users can buy, sell, and trade various digital assets, such as Bitcoin, Ethereum, and Solana.

Cryptocurrency exchanges come in different forms, with centralized exchanges being the most common. These platforms are owned and operated by a single entity, providing a user-friendly interface for trading. However, centralized exchanges are often criticized for their lack of security and control over users' funds.

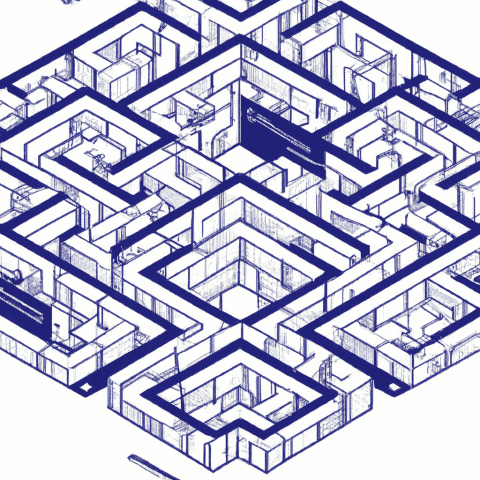

On the other hand, decentralized exchanges (DEXs) have gained popularity for their emphasis on security and user control. DEXs operate on blockchain technology, allowing users to trade directly with each other without the need for a central authority. This peer-to-peer trading model has attracted many users looking for a more secure and transparent way to exchange cryptocurrencies.

One of the key features of DEXs is their focus on crypto liquidity. Liquidity refers to the ease with which an asset can be bought or sold without impacting its price. DEXs rely on liquidity pools, where users contribute their assets to facilitate trades. This decentralized liquidity model has proven to be efficient and effective in ensuring smooth trading experiences on these platforms.

Some of the top DEXs in the market include Uniswap, SushiSwap, and PancakeSwap, each offering unique features and trading pairs. These platforms have become go-to destinations for users looking to swap their cryptocurrencies quickly and securely.

In conclusion, the rise of crypto exchanges has revolutionized the way we buy, sell, and trade digital assets. Whether you prefer the user-friendly interface of a centralized exchange or the security of a decentralized exchange, there are plenty of options available in the market. With the increasing popularity of cryptocurrencies like Bitcoin, Ethereum, and Solana, crypto exchanges play a crucial role in shaping the industry's future.