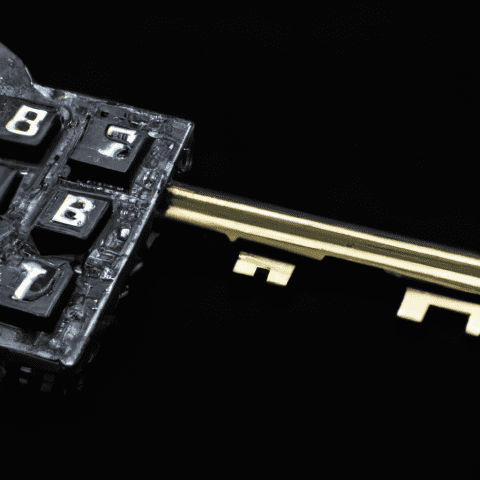

As the popularity of cryptocurrency continues to rise, so does the importance of understanding and implementing proper security measures to protect your digital assets. In this article, we will delve into the world of crypto security and blockchain hacking, exploring the risks of crypto hacks and strategies for safeguarding your investments. With the growing threat of crypto hacking, it is crucial for investors to be informed and proactive in defending against potential security breaches. Join us as we discuss the best practices for protecting your assets in the ever-evolving landscape of blockchain security.

1. "Protecting Your Investments: Understanding Crypto Security and Blockchain Hacking"

When it comes to investing in cryptocurrencies, one of the key factors to consider is the security of your digital assets. With the rise of blockchain technology, which underpins most cryptocurrencies, comes the risk of hacking and theft. Understanding crypto security and blockchain hacking is crucial for protecting your investments.

Blockchain security refers to the measures put in place to protect the decentralized ledger system that cryptocurrencies rely on. This includes encryption techniques, secure protocols, and consensus algorithms that ensure the integrity and immutability of the blockchain. However, even with these safeguards in place, hackers are constantly looking for ways to exploit vulnerabilities in the system.

Crypto hacks occur when hackers gain unauthorized access to digital wallets or exchanges, stealing funds from unsuspecting investors. These hacks can result in significant financial losses and damage to the reputation of the affected cryptocurrency. It is essential for investors to take proactive steps to secure their investments and minimize the risk of falling victim to a crypto hack.

One common method of blockchain hacking is through phishing attacks, where hackers create fake websites or emails to trick users into revealing their private keys or passwords. By being cautious of suspicious links and emails, investors can reduce the likelihood of falling for these scams. Additionally, using hardware wallets or cold storage solutions can provide an extra layer of security for storing cryptocurrencies offline.

In conclusion, protecting your investments in the world of cryptocurrencies requires a thorough understanding of crypto security and blockchain hacking. By staying informed about the latest security threats and taking proactive measures to safeguard your digital assets, you can minimize the risk of falling victim to a crypto hack. Remember to always prioritize security when investing in cryptocurrencies to ensure the safety of your funds.