In the fast-paced world of cryptocurrency trading, navigating the vast landscape of exchanges can be a daunting task for both beginners and experienced traders alike. From centralized exchanges to the rise of decentralized exchanges (DEXs), the options are endless when it comes to buying and selling digital assets. In this comprehensive guide, we will delve into the world of crypto exchanges, exploring the differences between centralized and decentralized platforms, the importance of DEXs, and the top DEXs to watch in the crypto space. We will also provide a detailed overview of crypto swaps, offering strategies for successful trading and maximizing liquidity on DEXs. Whether you're a Bitcoin enthusiast, an Ethereum investor, or looking to explore the future of trading on Solana, this article will help you navigate the world of crypto exchanges and make informed decisions when buying and selling digital assets.

1. Exploring the World of Crypto Exchanges: From Centralized to Decentralized

The world of cryptocurrency exchanges has evolved significantly over the years, offering a wide range of options for users to buy, sell, and trade digital assets. Centralized exchanges have traditionally been the go-to choice for many traders due to their user-friendly interfaces and high liquidity. These exchanges are operated by a central authority and require users to trust the platform with their funds.

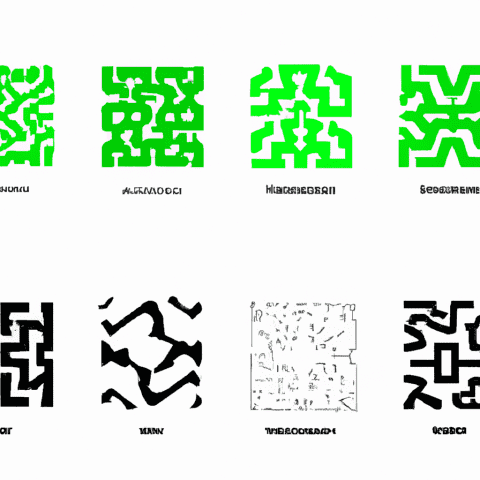

However, decentralized exchanges (DEXs) have been gaining popularity in recent years as they offer a more secure and private way to trade cryptocurrencies. DEXs operate on blockchain technology and allow users to trade directly with one another without the need for a central authority. This peer-to-peer trading model eliminates the risk of hacks and security breaches that are often associated with centralized exchanges.

Some of the top DEXs in the market include Uniswap, SushiSwap, and PancakeSwap, each offering unique features and a wide range of cryptocurrency pairs for trading. These platforms also provide users with the ability to swap between different cryptocurrencies, known as a crypto swap, without the need for a third party.

One of the key advantages of DEXs is their ability to provide users with greater control over their funds and privacy. Traders can connect their wallets directly to the exchange, allowing them to maintain ownership of their assets at all times. Additionally, DEXs offer higher levels of liquidity compared to traditional exchanges, as they tap into a global network of users looking to trade various cryptocurrencies.

As the crypto market continues to grow and evolve, decentralized exchanges are expected to play a crucial role in providing users with a secure and efficient way to trade digital assets. Whether you're looking to buy Bitcoin, Ethereum, Solana, or any other cryptocurrency, DEXs offer a decentralized and transparent alternative to centralized exchanges.