In the fast-paced world of cryptocurrency trading, navigating the various options for buying and selling digital assets can be overwhelming. From centralized exchanges to decentralized platforms, understanding the differences between each can greatly impact your trading experience. In this article, we will dive into the world of crypto exchanges, exploring the benefits of decentralized exchanges (DEXs) and highlighting the top DEXs to consider for trading popular cryptocurrencies like Ethereum and Solana. We will also discuss strategies for maximizing liquidity on DEXs, the rise of crypto swaps, and the advantages of using decentralized exchanges for buying and selling Bitcoin and Ethereum. Whether you are a seasoned trader or a newcomer to the crypto space, this article will provide valuable insights to help you navigate the ever-evolving landscape of cryptocurrency exchanges.

1. "Navigating the World of Crypto Exchanges: Understanding the Differences Between Centralized and Decentralized Platforms"

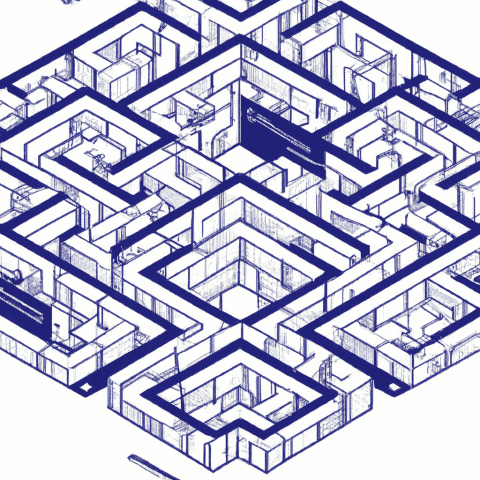

Navigating the world of crypto exchanges can be a daunting task, especially with the multitude of options available to traders. One of the key distinctions to understand is the difference between centralized and decentralized platforms.

Centralized exchanges, or CEXs, are traditional platforms that operate similarly to a stock exchange. These exchanges are run by a single entity and act as intermediaries between buyers and sellers. Examples of popular centralized exchanges include Binance, Coinbase, and Kraken. Centralized exchanges offer high liquidity and user-friendly interfaces, making them a popular choice for beginner traders.

On the other hand, decentralized exchanges, or DEXs, operate without a central authority and instead rely on smart contracts to facilitate trades. DEXs allow users to trade directly with each other without the need for a middleman. This decentralized approach offers increased security and privacy, as users retain control of their funds throughout the trading process.

Some of the top DEXs in the market include Uniswap, SushiSwap, and PancakeSwap. These platforms have gained popularity for their innovation and ability to provide users with access to a wide range of tokens. DEXs also offer higher levels of liquidity compared to centralized exchanges, as they tap into a global pool of liquidity provided by users.

When choosing between a centralized or decentralized exchange, it's essential to consider factors such as security, liquidity, and ease of use. Centralized exchanges may be better suited for beginners looking for a user-friendly experience, while more experienced traders may prefer the privacy and control offered by decentralized platforms.

In conclusion, the world of crypto exchanges offers a diverse range of options for traders. Whether you're looking to buy, sell, or swap cryptocurrencies, understanding the differences between centralized and decentralized platforms is crucial in navigating this ever-evolving landscape.